Cost-Effective

Get fast and straightforward services wherever you are. A single document is all it takes

Get fast and straightforward services wherever you are. A single document is all it takes

A responsible lending approach with a focus on security. We safeguard your information and provide help in tough spots

Simple solutions from home, fast. Instant money in your account and flexible loan terms

Enter your application details in the app by filling out the form.

Allow 15 minutes for our decision-making process.

Receive your money, typically transferred within a minute.

Enter your application details in the app by filling out the form.

Download loan app

In Kenya, quick loans have become a popular financial solution for many individuals in need of urgent funds. These loans offer a fast and convenient way to access cash when faced with unexpected expenses or emergencies. With the increasing popularity of mobile banking and digital platforms, quick loans have become more accessible to a larger segment of the population.

One of the main benefits of quick loans in Kenya is the convenience and speed at which funds can be accessed. Unlike traditional bank loans that may require extensive paperwork and long processing times, quick loans can be approved and disbursed within hours or even minutes. This makes them ideal for emergencies or situations that require immediate financial assistance.

Overall, the convenience and speed of quick loans make them a practical financial solution for individuals in need of quick access to funds.

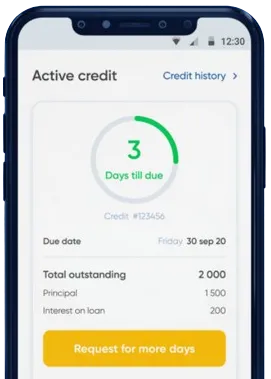

Another benefit of quick loans in Kenya is the flexibility they offer in terms of repayment. Borrowers can choose repayment terms that suit their financial situation, with options to repay the loan in full or in installments over a specified period. This flexibility makes it easier for borrowers to manage their finances and repay the loan without straining their budget.

Additionally, some quick loan providers in Kenya offer grace periods or extensions in case the borrower is unable to repay the loan on time. This ensures that borrowers are given some leeway in case of unexpected financial difficulties.

The availability of flexible repayment options makes quick loans a practical choice for individuals who may not have a steady income or who are facing temporary financial challenges.

Despite the convenience and speed of quick loans, borrowers in Kenya should be aware of the interest rates associated with these loans. While quick loans may have higher interest rates compared to traditional bank loans, many providers offer competitive rates that are within the regulatory guidelines set by the Central Bank of Kenya.

By being informed about interest rates and fees, borrowers can make an informed decision when choosing a quick loan provider in Kenya.

Quick loans in Kenya offer a convenient and fast way to access funds in times of need. With flexible repayment options and competitive interest rates, quick loans can be a practical financial solution for individuals facing emergencies or unexpected expenses. By understanding the benefits and considerations associated with quick loans, borrowers in Kenya can make informed decisions when seeking financial assistance.

Quick loans are short-term, unsecured loans that are typically processed faster than traditional loans. In Kenya, these loans can be accessed through mobile banking apps, online platforms, or microfinance institutions, offering a convenient way to borrow small amounts of money for urgent financial needs.

Generally, any Kenyan citizen who is at least 18 years old and meets the lender’s requirements can apply for a quick loan. Most lenders require applicants to have a valid national ID, an active mobile line, and in some cases, an M-Pesa or bank account.

Most quick loans in Kenya are processed within minutes to a few hours after approval. The funds are often disbursed directly to the borrower’s mobile money account or bank account, allowing for immediate access.

Loan amounts for quick loans in Kenya can range from as little as Ksh 500 to as much as Ksh 100,000 or more, depending on the lender and the borrower’s creditworthiness. Repayment periods typically range from one month to a few months.

Interest rates and fees for quick loans can vary significantly among lenders in Kenya. They are usually higher than those of traditional loans, with some lenders charging a flat fee or a percentage of the loan amount. It's important for borrowers to carefully review the terms and conditions before accepting a loan.

Loan repayments can be made through mobile money services such as M-Pesa or directly from the borrower’s bank account. Some lenders also offer payment through agents or over-the-counter at specified locations. Borrowers should ensure timely repayment to avoid penalties and negative impacts on their credit score.

If you default on a quick loan, lenders may impose late fees and higher interest rates. Additionally, your credit score may be negatively affected, which can limit your ability to access loans in the future. Persistent defaults may lead to legal action or being listed on the Credit Reference Bureau (CRB), impacting your creditworthiness.

Yes, quick loans in Kenya are regulated by the Central Bank of Kenya, which has established guidelines and frameworks to ensure fair practices in the lending market. Borrowers should deal only with licensed lenders to ensure their rights and interests are protected.